Forex Spread Betting Fundamentals Explained

Table of ContentsThe 7-Minute Rule for Forex Spread BettingSome Known Details About Forex Spread Betting Forex Spread Betting Can Be Fun For EveryoneWhat Does Forex Spread Betting Do?What Does Forex Spread Betting Do?Rumored Buzz on Forex Spread BettingIndicators on Forex Spread Betting You Need To Know

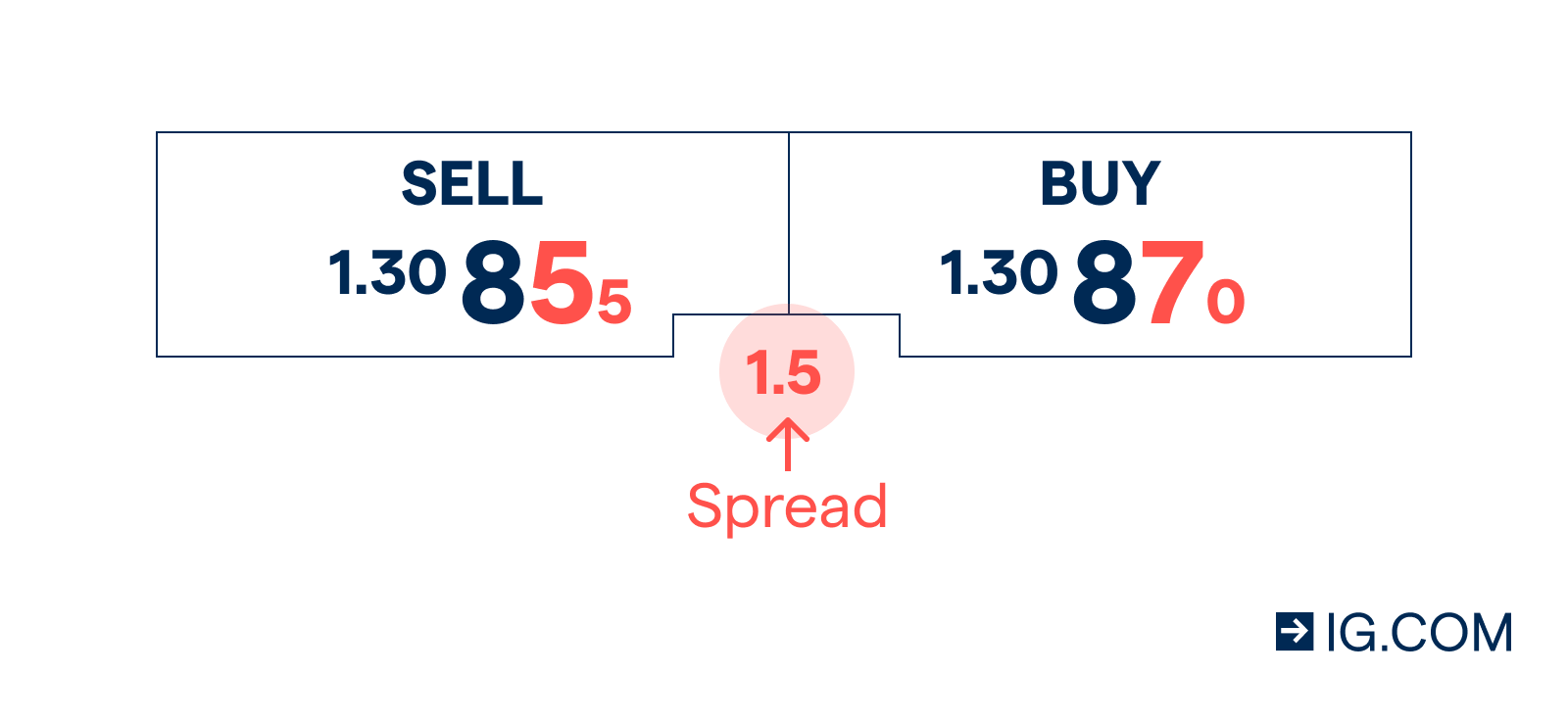

They provide relatively limited spreads but undergo overnight funding. This is a cost that you pay to hold a trading position overnight on leveraged trades. It is properly a passion repayment to cover the price of the take advantage of that you are making use of. Daily funded bets are normally made use of for temporary placements since of the impact of these overnight charges.

75. You make a decision to bet 10 per point. The share cost does certainly rally, to 170. 75 cent, and you determine to shut your position to take your earnings. Once again, a one-point spread applies, so the sell rate is 170 (forex spread betting). 25. The marketplace has moved in your favour by 19.

A Biased View of Forex Spread Betting

As we have seen, among the advantages of spread wagering is that you can multiply the impact of your bet through take advantage of. To put it simply, you just need to transfer a little portion of the total worth of any type of trade. This is referred to as the margin. If the margin requirement for a profession is 20 per cent, after that you would just require 20 per cent of the full value of the trade in your account to open the placement.

, which describes just how take advantage of works when you spread out bet on supplies. The same principles apply to all other financial tools that you spread out bet on.

You determine to get 1000 shares in ABC plc at a price of 5 each in the idea that the business's profits are concerning to skyrocket. If you just got the shares directly on the securities market, the total cost would certainly be 5000 (1000 shares x 5 per share). However, you might attain the exact same direct exposure by getting a spread bet of 10 per point on the exact same business, as well as you would only have to provide a deposit, or margin, of 1000 because the broker is supplying you leverage of 5:1.

4 Easy Facts About Forex Spread Betting Described

You must constantly ensure the funds in your account are enough to cover any kind of losses from existing trades. Otherwise, there is a threat that the broker may just shut your settings, leaving you with losses. The advantages of spread wagering consist of: There is no stamp duty to pay, as well as any type of earnings you make are tax-free. forex spread betting.

It is very easy to trade via an online broker, either in your house or on the go. You can bet that the price of an instrument will certainly climb or drop.

The Ultimate Guide To Forex Spread Betting

Spread wagering on shares grants capitalists no privilege to dividends or the various other legal rights appreciated by shareholders. By comparison, with spread betting you basics can lose 2, 3 or even 10 times your initial stake within a couple of minutes as a repercussion of take advantage of.

Although take advantage of implies you can trade a big amount with a reasonably tiny amount, spread betting can be remarkably capital intensive. That is due to the fact that you always need to keep a huge amount on reserve to cover any kind of losses as well as prevent a margin call or, even worse still, have the broker shut your account.

Spread-betting markets can be exceptionally unstable. While this produces rewarding opportunities, it can additionally prove hazardous, with prices moving greatly in either instructions. This can lead to significant losses generating over a short period. You are getting in right into an agreement with the broker and also there is constantly the danger that the various other party click here to read to the agreement can fail or, when it comes to an uncontrolled broker, simply renege on the deal.

Examine This Report on Forex Spread Betting

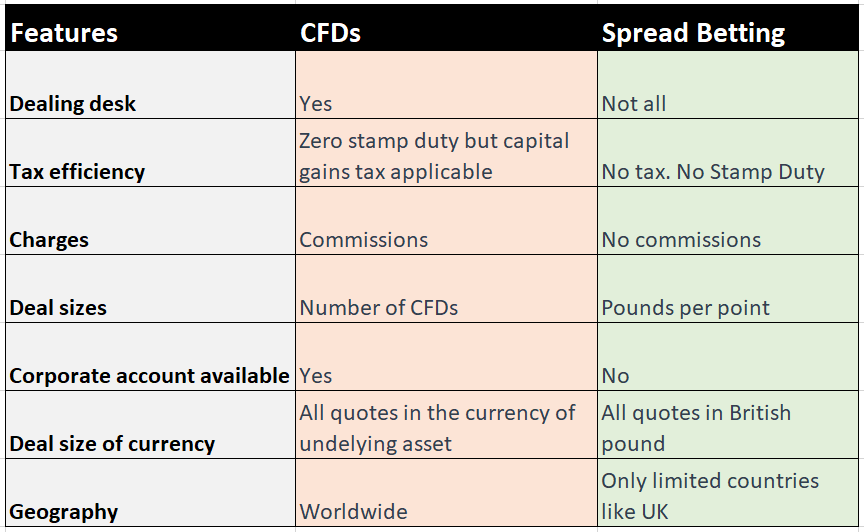

Both take advantage of take advantage of and permit capitalists to gain from movements in the costs of a vast array of financial instruments. You can utilize either spread wagering or CFDs to wager that a product will increase or drop in value. The key distinction between the two items is that revenues from spread wagering are cost-free from tax obligation, while make money from CFDs undergo resources gains tax in the UK.

In enhancement, while you do not pay a payment on spread wagering, brokers may bill a commission to trade in CFDs. Given the threats involved in spread wagering, it is critical that you are mindful of the actions you can require to minimize any losses. You can guard versus the threat of losing greater than your deposit in a trade by establishing an automated quit, or limitation, to define the level at which you would certainly like your trade to be shut.

Spread wagering on shares grants investors no privilege to rewards or the other legal rights enjoyed by shareholders. By comparison, with spread betting you can shed two, three or even ten times your initial stake within a couple of mins as an effect of leverage.

The Main Principles Of Forex Spread Betting

Although utilize implies you can trade a large amount with a reasonably little amount, spread betting read here can be remarkably capital intensive. That is due to the fact that you constantly require to keep a large amount on get to cover any losses as well as stay clear of a margin phone call or, even worse still, have the broker close your account.

Spread-betting markets can be incredibly unpredictable. While this develops rewarding possibilities, it can also show harmful, with rates relocating dramatically in either direction. This can cause considerable losses accumulating over a short period. You are getting in into a contract with the broker as well as there is constantly the threat that the other celebration to the agreement can fail or, when it comes to an unregulated broker, simply break the offer.

How Forex Spread Betting can Save You Time, Stress, and Money.

In addition, while you do not pay a commission on spread wagering, brokers may charge a payment to sell CFDs. Offered the dangers associated with spread betting, it is critical that you know the measures you can take to reduce any losses. You can safeguard against the risk of shedding even more than your down payment in a trade by setting an automated quit, or limit, to define the level at which you would certainly like your trade to be shut.